jersey city property tax rates

6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252. Tax amount varies by county.

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Jersey City Hall 280 Grove Street Room 116.

. 2019 Agendas Minutes. Jersey City Union City Irvington Bloomfield etc. The median property tax in Hudson County New Jersey is 6426 per year for a home worth the median value of 383900.

The remaining 63 of the property tax goes to the county. Mayor Steve Fulop hailed the news on Twitter. Office of the City Assessor.

201 547 5132 Phone 201 547 4949 Fax The City of Jersey. 11 rows City of Jersey City. 189 of home value.

The average tax rate in Jersey City New Jersey a municipality in Hudson County is 167 and residents can expect to pay 6426 on average per year in property taxes. Not in New Jersey. The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents.

Below is a town by town list of NJ Property tax rates in Somerset County. North Plainfield has the highest property tax rate in Somerset County with a. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Jersey City establishes tax levies all within the states statutory rules. Eduardo CToloza CTA City Assessor. By Mail - Check or money.

All real property is assessed according to the same standard. City of Jersey City Tax Assessor. The average effective property tax rate in New Jersey is 242 compared to the national average of 107.

Jersey Citys 2021 school tax rate was 052 and Jersey City sent 37 of their property tax dollars to the schools. Lowest and Highest 2021 Property Tax Rates and Tax Bills for Hudson County NJ. Assessed Value x General Tax Rate100 There is a property tax levied on property owners.

HOW TO PAY PROPERTY TAXES. See Rates for All Areas. Somerset County Property Taxes.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. New Jerseys real property tax is an ad valorem tax or a tax according to value. Property tax rates in New Jersey vary significantly by city and.

2020-2022 Agendas Minutes and Ordinances. Account Number Block Lot Qualifier Property Location 18 14502 00011 20. Online Inquiry Payment.

To view Jersey City Tax Rates and Ratios read more here. Hudson County collects on average 167 of a propertys assessed. General Property Tax Information.

Jersey City New Jersey 07302. In New Jersey property taxes are calculated using the formula. TO VIEW PROPERTY TAX ASSESSMENTS.

The General Tax Rate is used to calculate the tax assessed on a property. NEW -- New Jersey Map of Median Rents by. In Person - The Tax Collectors office is open 830 am.

Description The office of the City Assessor shall. City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel. It is equal to 10 per 1000 of the propertys taxable value.

How Do State And Local Property Taxes Work Tax Policy Center

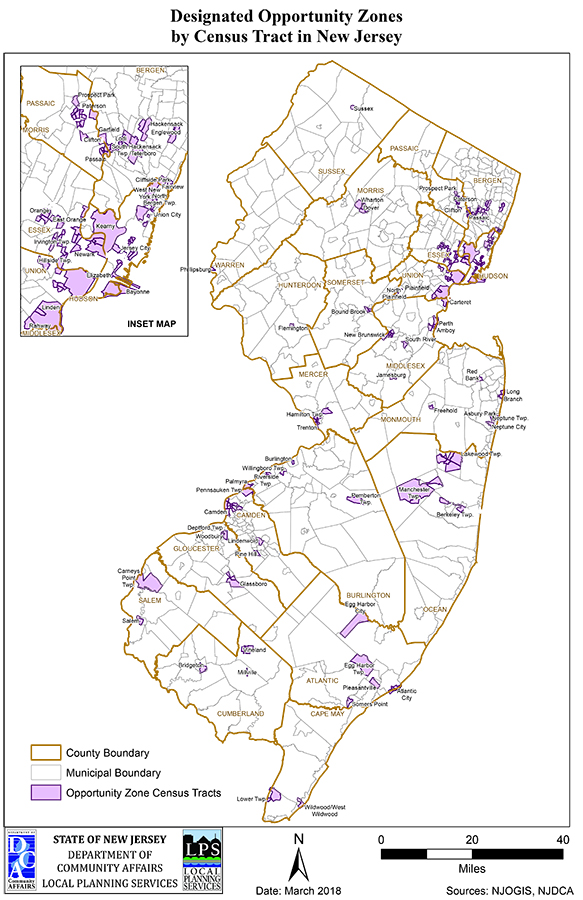

Nj Department Of Community Affairs

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

Tarrant County Tx Property Tax Calculator Smartasset

These Towns Have The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

Jersey City New Jersey Wikipedia

New Jersey Property Tax Calculator Smartasset

New Jersey Sales Tax Rate Rates Calculator Avalara

Here Are The 30 N J Towns That Sock Homeowners With The Highest Property Tax Rates Nj Com

The 10 Worst States For Property Taxes Guess Nj Is Washington 2015 Credit Rating New Jersey City Data Forum

Tax Assessor City Of Jersey City

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Once Again Study Says New Jersey Has Country S Highest Property Taxes Jersey Digs

Jersey Village City Council Approves 17m Budget Tax Rate Increase For 2021 22 Community Impact

Putting Jersey City S Low School Tax Rate Into Perspective Civic Parent

N J Raised Tax Rates In 18 But Dropped Some Too Nj Com

Atlantic County Nj Property Property Tax Rates Average Tax Bills And Residential Assessments