how are annuities taxed to beneficiaries

For non-spouse beneficiaries of qualified annuities taxes depend on the payout structure that the beneficiary selects. The proceeds from an annuity death benefit are taxable when they are received by the beneficiary.

Using Annuities For Spendthrift Protection In Estate Planning

Taxes and Annuity Payouts.

. Your annuity income payments are classed as earned income and are subject to income tax just like the salary you will have received during your working life. Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both. An annuity contract provides for tax-deferred growth of the money invested and an option to turn a lump-sum amount into a guaranteed income.

Depending on. But taxation on contributions and. In the case where the recipient is a surviving spouse he or she can initiate certain.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. If theres a beneficiary they will inherit the annuity and usually have the option to take out the remaining sum and death benefits.

Considering the Beneficiary of Your Annuity. Taxes at Death. Ad Get this must-read guide if you are considering investing in annuities.

This so-called inherited annuity is the outcome. Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity. Taxability of Annuities for Beneficiaries.

Browse Get Results Instantly. If the beneficiary selects a lump sum payment they must pay taxes. When an annuity owner dies the person or people identified as beneficiaries receive the annuity balance and must pay taxes on that amount.

Ad Search For Info About Are inherited annuities taxable. But this is not the case when inheriting an. If the surviving spouse is the beneficiary they can become.

Beneficiaries of Period-Certain Life Annuities. We help fiduciary and legal professionals locate estate beneficiaries a better way. For variable annuity contracts issued on or after 102979 and for all fixed annuity contracts there is no step-up in basis for income tax purposes and the beneficiary pays income tax on.

When you inherit an annuity you assume what is referred to as the owners basis which means you own the amount of already-taxed money in the account. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit. These payments are not tax-free however.

The simplest option is to take the entire amount as a lump sum. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Benefits paid to a survivor under a joint and survivor.

The beneficiary must figure the tax-free part of each payment using the method that applies as if he or she were the employee. Ad Thousands of successful searches every year. When an individual inherits a life insurance policys death benefit they typically will not have to pay any income taxes.

Your relationship to the beneficiary matters when it comes to annuity payments and taxation so. And you have the same amount of. How Annuities Are Taxed.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers.

How Are Annuities Given Favorable Tax Treatment Due

Annuity Beneficiary Learn Payout Structure Death Benefits More

Annuity Tax Consequences Taxes And Selling Annuity Settlements

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

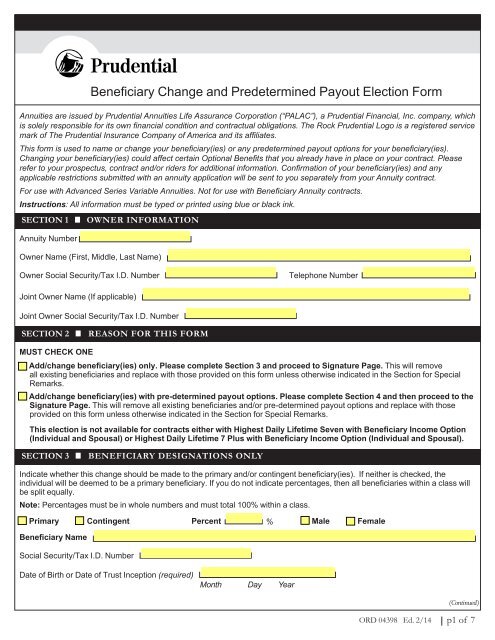

Beneficiary Change And Predetermined Payout Election Form

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

The Annuity Advantage By Blue Horizon Insurance Financial Services Ppt Download

Annuity Change Of Beneficiary Form American General Life

![]()

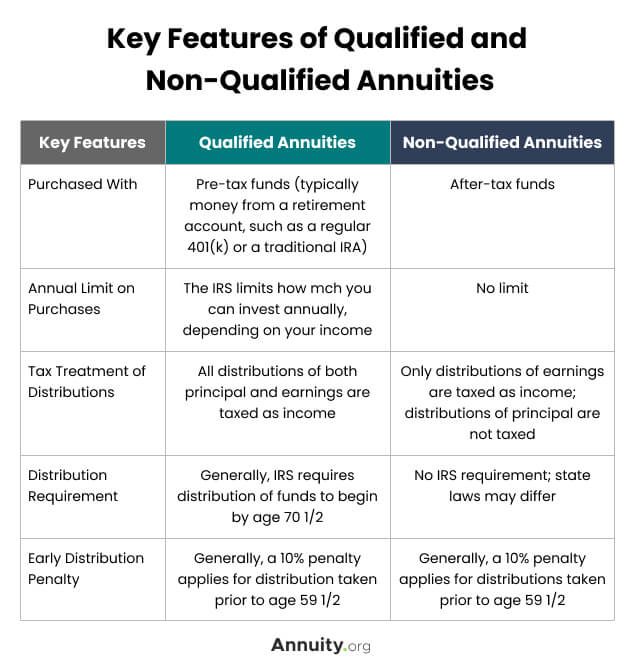

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

The Pros And Cons Of Annuities Aim Inc

Qualified Vs Non Qualified Annuities Taxation And Distribution

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

Common Tax Traps Involving Nonqualified Annuities Gwa Blog

Trust Vs Restricted Payout As Annuity Beneficiary

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain